Board Newsletter | Issue 9

Published October 2025

2025 Legislative Implementation

Impacting Your HOA

As you may be aware, HB-1043, Owner Equity Protection in Homeowners’ Association Foreclosure Sales, became effective on October 1, 2025. This new legislation requires all HOAs to adjust policies related to unpaid assessments and lien foreclosures.

By now, most communities have updated their collection policies in consultation with their legal counsel. If your association has not yet done so, please update your policy as soon as possible, particularly if you plan to refer delinquent accounts to legal counsel for collection.

Actions Taken by Advance HOA Management

To comply with the new legislative requirements, Advance HOA Management has implemented the following measures:

1. Collection Policy Updates

We have requested that all associations review and update their collection policies to ensure full compliance with the new law.

2. Revised Notice of Delinquency

The Notice of Delinquency letter has been modified to include:

-

A statement that owners may request an HOA ledger verifying owed amounts, which must be provided within seven (7) business days of the request.

-

References to the HOA Information & Resource Center (DORA) regarding the collection of assessments and the HOA’s ability to foreclose on an association lien. The notice also includes a link to HUD credit counseling resources available through the Department of Local Affairs (DOLA) website.

-

A statement advising that a foreclosure sale could result in the loss of some or all of an owner’s equity in their property.

3. Annual HOA Filings with DORA

The Department of Regulatory Agencies (DORA) has significantly expanded the reporting requirements for HOA annual filings, as outlined in its September 22, 2025 update. Advance HOA Management will now produce custom reports, implement new internal procedures, and conduct manual data collection to comply with these requirements.

The following information is now required for each HOA’s annual filing:

-

Legal name of the association (as registered with the Colorado Secretary of State)

-

Association address

-

Secretary of State ID number, date of incorporation, and entity type (e.g., corporation, LLC)

-

Type of community (e.g., condominium, planned development, cooperative)

-

Number of units in the community

-

Whether the association is self-managed or professionally managed

-

Designated agent’s name, address, telephone number, and email address

-

Whether annual revenue exceeds or is less than $5,000

-

Number of unit owners six (6) or more months delinquent in assessments during the past 12 months

-

Number of judgments obtained for unpaid assessments or related fees

-

Number of payment plans entered into pursuant to §38-33.3-316.3, C.R.S.

-

Number of foreclosure actions filed pursuant to §38-33.3-316, C.R.S.

-

Number of board positions established by governing documents

-

Number of vacant board positions as of the registration date

-

Current average assessment amount

-

Frequency of assessment billing (monthly, quarterly, etc.)

-

Percentage change in assessments over the past 12 months

-

Number of payment plans offered during the past 12 months

-

Number of owners who successfully completed payment plans

-

Total amount of late fees and interest collected as a percentage of total revenue

-

Total amount of late fees and interest assessed and waived as part of payment plans

4. Owner Contact Information Updates

To meet new owner communication requirements, HOAs must periodically request updated contact information, including telephone numbers, mobile numbers (for texts), and email addresses for both owners and their designated contacts.

Advance HOA Management will distribute contact update forms up to twice per year and will integrate these requests with other mailings—such as billing statements—when possible to minimize costs. Your assigned community manager will keep you informed of any impacts or next steps for your association.

Thank you for your continued cooperation as we navigate and implement these important legislative changes impacting HOA operations throughout Colorado.

Winter Care Brings Spring Rewards

Preparing Our Trees for Winter

As we enter into fall in Colorado, now is the prepare your trees for winter. By following best practices informed by Colorado State University and its extension partners, we can help our trees stay healthier through winter and bounce back strongly in spring.

Hydrate Before Freeze

Before soil freezes solid, give trees a “last drink.” Water slowly and deeply under the dripline (the ground area beneath the tree’s outer branches). A useful rule of thumb is 10 gallons per inch of trunk diameter.

Conifers especially benefit from fall watering, as they continue to lose moisture through their needles in winter. During dry spells in winter (more than two weeks without snow cover), provide supplemental water on warm days when temperatures are about 40 degrees.

Mulch

Apply 2–4 inches of organic mulch (wood chips, shredded leaves, bark) around the base of the tree, but leave a gap between the mulch and the trunk to prevent rot.

Wrap Thin-Barked Trees

Young trees with thin bark—such as honey locust, linden, and maple—are vulnerable to sunscald and frost cracks in Colorado’s freeze / thaw cycles. Wrapping trunks (up to the first branch) helps mitigate these stresses. Be sure to remove wraps come spring (around April) so growth is not impeded.

Delay Major Pruning

Although cleaning up dead limbs is okay now, major structural pruning is best deferred until late winter or early spring while trees are fully dormant. When pruning, always cut just outside the branch collar (never flush to the trunk), and avoid removing branches without strong reason.

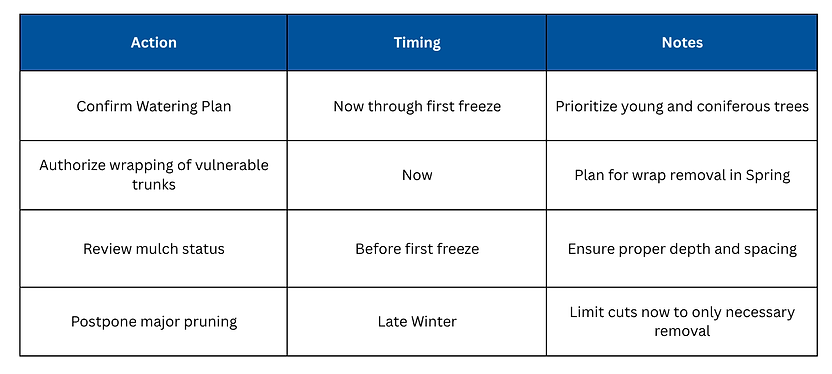

Quick Checklist for Board Oversight

Taking these steps now will help reduce winter stress, improve survival, and encourage strong growth next season.

Additional information:

The Management Fee Matrix

Expectations for Your Community Manager's Time

Community managers are assigned a portfolio of communities. As part of the assignment, leadership evaluates the size of a portfolio based on many factors, such as number of units, age of properties, community types (single family, condo, townhome, metro district), invoice volume, call volume, board meeting frequency, and community locations. The management fee is directly related to these same characteristics and helps gauge the time commitment for the assigned manager to each community. Because a manager is not a full-time manager to a community, we rely on a positive partnership with the Board to ensure the community is properly functioning.

Below is a table that provides directional guidance on approximately how many hours per week a manager should spend, on average, on a community based on their monthly management fee. As projects and commitments ebb and flow, naturally this commitment will vary. However, this is a helpful reference for time spent, on average. Please keep in mind that the management fee includes accounting services, resale facilitation, enforcement, software, administrative support, etc.

We hope you find this helpful in assigning projects to the manager, establishing manager priorities, and setting expectations. If you have any questions, please do not hesitate to reach out to your manager.

HOA Meeting Minutes

Keeping the Record Straight

To know where you’re going, you have to know where you’ve been. This famous saying is all too applicable to HOAs where institutional memory can be as short as the terms of board members and boards can unwittingly address the same issues over and over again. Perhaps the most important thing to understand about keeping proper minutes is that minutes are the record of the official actions taken by the board or the members and that an official action requires a vote.

What should minutes look like?

Anyone reading the minutes should be able to easily understand, at a minimum, what actions were taken and how they were approved. There is no hard and fast rule regarding the level of detail to be included in minutes, but minutes should reflect what was done, not what was said. Minutes should not record every detail or statement said at the meeting and they should not reflect conversations. However, there should be enough information to make the minutes useful when they are used for reference or offered as evidence that an action was properly taken or that directors fulfilled their fiduciary duties. Boards and secretaries tasked with recording or approving the minutes must understand the purpose and eventual use of minutes, and then use their best judgment about the degree of specificity provided in the minutes.

Boards should also be mindful of how they handle confidential or sensitive information. For example, if the board holds an executive session to discuss confidential or sensitive matters, the minutes of the meeting should indicate that the board met in executive session and the topic of the discussion, but the specifics would likely be confidential and appear only in a set of confidential-to-the-board minutes or other notes. A separate recordkeeping system should be established for such confidential information to easily distinguish it from records that a member would otherwise be entitled to view.

What should minutes not look like?

Minutes should not record discussions or contain owner comments and should never be a transcript of every statement made by directors and others. Doing so creates potential defamation claims, becomes evidence for other claims against the board and the association, and can dissuade potential purchasers and lenders who may believe that a negative issue is much more serious than it really is. Minutes should reflect decisions and reasons for those decisions, not discussions or specific conversations.

At a minimum, board meeting minutes should include:

-

Name of the association (always use the exact legal name).

-

Date, time, location and type of meeting (regular, special, emergency, executive session).

-

Names of directors in attendance and directors not in attendance, including the office they hold, if any (president, secretary, etc.), and names of guests in attendance who were invited to speak to the Board (contractors, attorney, accountant, etc.). Members in attendance should not be listed.

-

Whether a quorum was established.

-

Any board actions (e.g., approvals, delegations of authority, directives). It’s not necessary to show the names of those voting in favor, abstaining and in opposition to a motion, but it’s sometimes not a bad idea, especially to show those dissenting, in order to limit personal liability for the consequences of an action they disagree with. Also include any actions (decisions, votes) taken between meetings and include details documenting that proper procedure was followed.

-

General description of matters discussed in executive session.

Additional Suggestions:

-

Include alternatives considered for important decisions to show diligence and reasonable care.

-

Consider attaching reports given to the board (so long as they may not be misconstrued to be prejudicial to the organization or to the board).

-

Record recusals from discussions and abstentions from voting;

-

Prepare a list of action items separate from the minutes, what people commit to do.

-

It’s crucial that minutes are prepared so as to document actions of the board now but without creating problems in the future. Additionally, with the turnover experienced in association boards, it is critical to have good, complete but concise minutes so that future boards do not find themselves “reinventing the wheel” on issues that have already been addressed.

Source:

Curtis Kimble

Attorney at Law, Utah

HOA Law